Exciting Career Opportunity at National Refinery Limited

We are excited to announce an opening for the position of Chief Financial Officer (CFO) at National Refinery Limited (NRL)!

| No | Qualifications | Position | Experience | Location |

| 1 | Finance | CA, CPA, CFA | Minimum 20 Years | Karachi, Pakistan |

Are you a seasoned finance professional with a proven track record of strategic financial leadership?

Do you thrive in dynamic environments and have a passion for driving organisational growth?

If so, we want to hear from you!

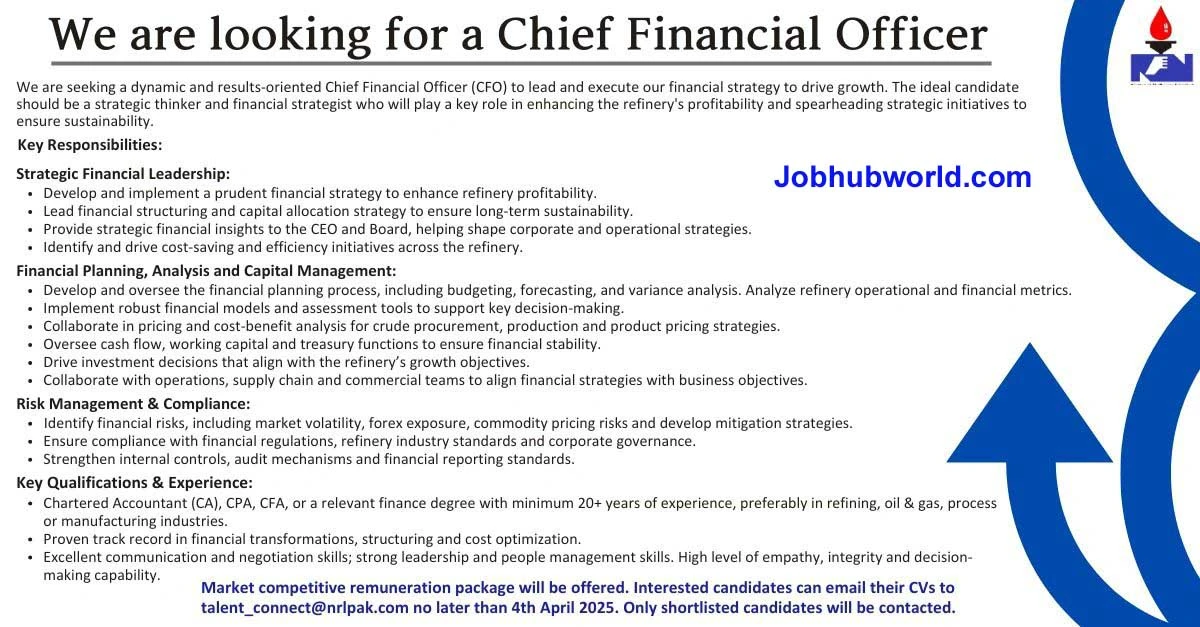

Check out the image below for full job details and requirements.

Apply Now: talent_connect@nrlpak.com citing the position in the subject line.

Deadline: April 4, 2025

National Refinery Limited (NRL) is a prominent Pakistani oil refining company, established on August 19, 1963, as a public limited entity. Situated in Karachi’s Korangi Industrial Area, NRL plays a pivotal role in the nation’s energy sector by manufacturing, producing, and marketing a diverse array of petroleum products.

PSX DATA PORTAL

Refinery Complex and Capacity

NRL’s refinery complex is comprised of three main units: two lube refineries and one fuel refinery. The first lube refinery commenced operations in 1966 with a designed capacity of 3,970,500 barrels per annum for crude processing and 533,400 barrels per annum for lube base oils. The second lube refinery was commissioned in 1985, initially designed to produce 700,000 tons per annum of lube base oils, which was later expanded to 805,000 barrels per annum after a revamp in 2008. These lube refineries process reduced crude to produce lube base oils, bitumen, wax, and other specialty products. The BTX (Benzene, Toluene, Xylene) petrochemical plant, commissioned in 1979, has a design capacity of 180,000 barrels per annum. The fuel refinery began operations in 1977 with a designed capacity of 11,385,000 barrels per annum of crude processing, which was later increased to 18,603,000 barrels per annum through two phases of upgradation.

BUSINESS RECORDER

Product Portfolio

NRL’s extensive product range caters to both domestic and international markets, including:

Fuels:

| 1 | Motor Gasoline (Mogas): High-quality gasoline for automotive use. |

| 2 | High-Speed Diesel (HSD): Diesel fuel for transportation and industrial applications. |

| 3 | Kerosene: Fuel for aviation and heating applications. |

| 4 | Furnace Oil: Used in power generation and industrial processes. |

| 5 | Liquefied Petroleum Gas (LPG): Versatile fuel for heating, cooking, and automotive use. |

Lubricants:

A wide variety of automotive and industrial lubricants designed for different applications.

Bitumen:

Used in road construction and maintenance.

Petrochemicals:

Production of petrochemical products for various industrial applications.

Specialty Products:

Benzene, Toluene, Xylene, Slack Wax, and Extract Oil.

Technological Advancements

To align with international environmental standards and improve product quality, NRL has invested in technological upgrades:

Diesel Hydro Desulphurisation (DHDS) Unit: Commissioned in 2017, this unit enables the production of low-sulfur (EURO II Standard) High-Speed Diesel (HSD), reducing sulfur emissions and contributing to a cleaner environment.

BUSINESS RECORDER

Isomerisation (ISOM) Unit: Commissioned in 2018, this unit processes light naphtha into motor gasoline, enhancing the octane rating of gasoline and improving fuel efficiency.

BUSINESS RECORDER

Ownership and Management

NRL became part of the Attock Group following its privatization in 2005. The company’s ownership structure includes:

| 1 | Attock Refinery Limited (25%) |

| 2 | Pakistan Oilfields Limited (25%) |

| 3 | Islamic Development Bank (15%) |

| 4 | As of June 30, 2023, NRL employed approximately 971 individuals. |

Financial Performance

NRL’s financial performance has experienced fluctuations over the years, influenced by global oil price volatility, exchange rate movements, and domestic demand variations. The company’s revenues increased significantly from FY10 to FY14 but faced challenges post-FY14 due to falling petroleum product prices amid a global supply glut. In FY17, NRL commissioned its Diesel Hydro Desulphurisation Project to produce low-sulfur (EURO II Standard) High-Speed Diesel (HSD), aligning with environmental standards and improving product quality.

However, in FY18, NRL’s earnings fell by 78% year-on-year due to losses incurred by the fuel segment, despite a 27% increase in revenues. The decline in profitability was attributed to higher operating costs, including depreciation on new units, exchange losses, customs duty on crude oil, and lower returns on bank deposits. In FY19, NRL incurred a loss due to volatility in oil prices, increased product prices, and sharp currency devaluation.

The fuel segment’s losses increased due to significant exchange losses, uneven product margins, customs duty on imported crude, and higher mark-up costs on short-term finance. The lube segment managed to earn a profit, albeit lower than FY18 levels, due to increased feed costs and asymmetrical product price increases. The company also faced lower demand for Bitumen due to reduced road infrastructure development. In FY20, NRL’s performance was affected by the COVID-19 pandemic, with the refinery sector among the worst-hit industries due to lower upliftment.

However, in FY21, NRL posted a profit versus losses in the previous couple of years, primarily due to the lube segment’s performance. Margins further improved due to the production of Euro-V standard HSD and profitability benefited from exchange gains. The lube segment’s earnings increased due to better Bitumen sales (up by 19% year-on-year) and global lube base oil supply constraints easing during the year. Also, the Lube-1 refinery upgradation and revamp resulted in increased capacity to 70,000 barrels per day from 65